In 2024, India’s Unified Payments Interface (UPI) handled over 117 billion transactions worth more than $2 trillion. This digital marvel, born in Mumbai’s bustling fintech scene, now pulses through the veins of everyday life—from street vendors in Delhi to tech hubs in Bangalore. Picture a world where a simple QR code scan settles a bill in seconds, no cash needed. That’s UPI for you, a quiet revolution that has turned India into a global payments powerhouse.

In 2024, India’s Unified Payments Interface (UPI) handled over 117 billion transactions worth more than $2 trillion. This digital marvel, born in Mumbai’s bustling fintech scene, now pulses through the veins of everyday life—from street vendors in Delhi to tech hubs in Bangalore. Picture a world where a simple QR code scan settles a bill in seconds, no cash needed. That’s UPI for you, a quiet revolution that has turned India into a global payments powerhouse.

Yet, this homegrown system whispers secrets of deeper ties across the Himalayas. Chinese businesses, hungry for India’s vast market of 1.4 billion consumers, have quietly woven themselves into the UPI fabric. They deploy apps and e-commerce platforms that let Indian shoppers pay seamlessly for gadgets and apparel sourced from Shenzhen factories. Amid border tensions that once cast long shadows, these financial threads pull the two giants closer. One such bridge is the India payment channel (印度支付), a platform easing flows for cross-border deals. It’s like a hidden river carving paths through rocky divides, fostering trade where talks alone falter.

The Magic of UPI in Everyday Exchange

UPI started as a simple idea: link bank accounts to mobile phones for instant transfers. Today, it boasts over 500 million users, processing 20 billion transactions in August 2025 alone—equivalent to 7,500 buzzes per second. Merchants love it; no hefty fees like those from Visa or Mastercard, often 1.5% to 3%. Instead, UPI keeps costs near zero, a boon for small shops and street carts alike.

- Speed wins hearts. Funds zip in real time, turning wary cash-lovers into digital devotees.

- Inclusion blooms. Rural folks, once sidelined by banks, now join the flow with basic smartphones.

- Global eyes turn. From Singapore’s PayNow to Qatar’s QR codes, nations borrow UPI’s blueprint.

But here’s the twist that dances with destiny. Chinese firms, giants like Alibaba and Xiaomi, integrate UPI into their Indian arms. A Delhi teen buys a budget smartphone on Flipkart, scans a code, and poof—payment done. Behind the curtain, yuan converts to rupees via UPI rails, fueling a trade engine that hit $118 billion in 2024. It’s poetry in motion: electronics flood in, deficits grow, yet connections deepen.

Chinese Footprints on Indian Digital Soil

China’s e-commerce titans first tiptoed in with apps like Shein and Temu. These platforms lure Indian buyers with cheap fashion and gadgets, all paid via UPI. By 2025, Chinese exports to India topped pharmaceuticals and machinery, but consumer goods ride the digital wave. Xiaomi sells millions of phones here; each UPI ping cements their foothold.

Enter emerging players like Tata’s ventures. Tata Payment.net emerges as a fresh conduit, blending Indian innovation with cross-border needs. Chinese suppliers use it to settle invoices swiftly, dodging dollar delays. “It’s like unlocking a garden gate,” says Rajesh Kumar, a Mumbai importer of LED lights. “Payments arrive before the shipment does—smooth as monsoon rain.”

“UPI isn’t just tech; it’s trust in a bottle, poured across borders,” notes fintech analyst Priya Singh, her voice warm like evening chai.

- Cost cutters thrive. No middlemen fees mean more profit for Beijing exporters.

- Market magic. India’s youth, glued to screens, snap up Chinese trends via UPI ease.

- Risks linger. Data flows raise eyebrows—does every scan feed foreign servers?

This fusion stirs the pot of politics. Remember the 2020 Galwan clash? Tensions spiked, apps banned, yet trade soared. Why? Payments like UPI create stakes too high to sever. Diplomats haggle over maps; merchants mend fences with money.

Threads of Trade Weaving Diplomatic Dreams

India’s trade deficit with China swelled to $99 billion in 2024-25. Critics cry foul—too much reliance on Beijing’s factories. But payments platforms flip the script. UPI’s low-friction flow encourages joint ventures, from solar panels to EVs. Tata and Chinese firms co-build batteries; UPI settles the scores.

Geopolitics simmers beneath. As U.S. tariffs bite—50% on Indian goods by August 2025—Delhi eyes Beijing anew. Modi-Xi summits in Tianjin whisper of reopened borders and flights. “Trade is the soft hand extending peace,” quips economist Li Wei from Shanghai, his words like silk threads binding old rivals.

- BRICS bonds tighten. Shared currencies via New Development Bank sidestep dollar drama.

- Border posts revive. Nathu La trade resumes, UPI tagging along for quick swaps.

- Green goals align. Payments fund solar ties, cooling climate spats.

Yet, shadows dance. Water disputes rage; rare earth curbs pinch. Can payments heal? Perhaps. They build habits harder to break than pacts on paper.

READ ALSO: 5 Ways Digital Cashing Services Shape Political Campaign Financing in Korea

A Bridge Over Himalayan Winds

Imagine two dragons, scales brushing in the mist—one red, one saffron. UPI and kin like Tata Payment.net are the winds that lift them, not clash. Chinese businesses tap India’s pulse, turning deficits into dialogues. In 2025’s SCO halls, handshakes follow transaction trails.

This financial bridge reshapes maps. Trade blooms, envoys talk, youth connect. It’s no fairy tale; frictions flare. But in the glow of a scanned code, hope flickers—a reminder that money mends what marches mar.

As India’s payment systems evolve, so does the dance with China. Will it lead to harmony or just a graceful pause? Only time, and a few billion pings, will tell. For now, savor the rhythm: two ancient lands, linked by the hum of digital gold.

More than 500,000 people in the United States rely on the Deferred Action for Childhood Arrivals (DACA) program to legally work and study. But every time political tides change, so does their financial stability. The DACA policy, first introduced in 2012, gave undocumented immigrants brought to the U.S. as children a chance to come out of the shadows. While it provided protection from deportation and work permits, it never offered permanent legal status. That limited protection continues to place DACA recipients at economic risk.

More than 500,000 people in the United States rely on the Deferred Action for Childhood Arrivals (DACA) program to legally work and study. But every time political tides change, so does their financial stability. The DACA policy, first introduced in 2012, gave undocumented immigrants brought to the U.S. as children a chance to come out of the shadows. While it provided protection from deportation and work permits, it never offered permanent legal status. That limited protection continues to place DACA recipients at economic risk.

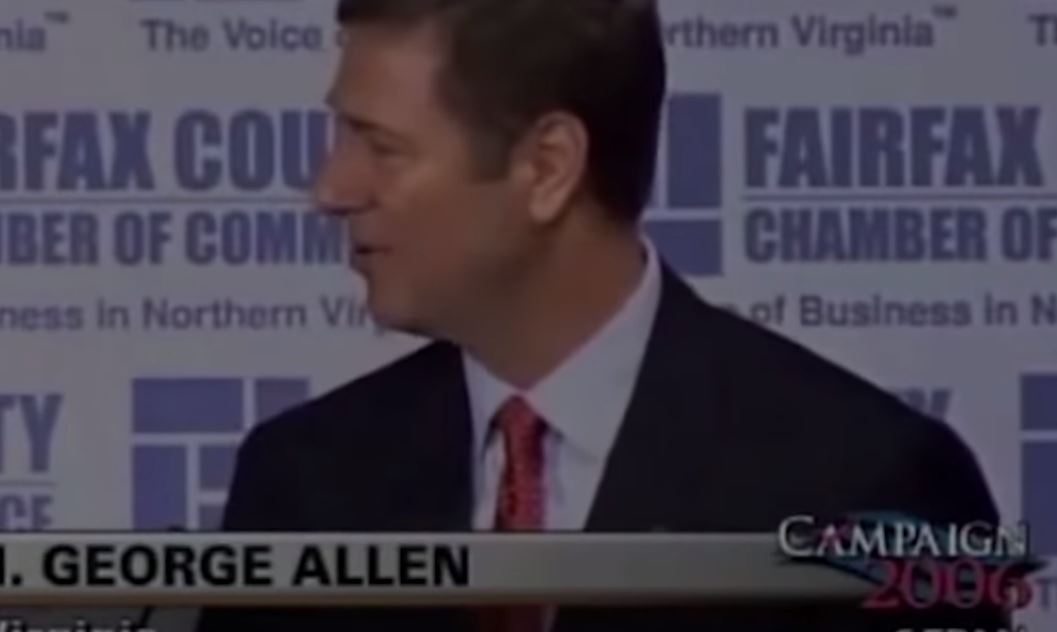

At the Republican Party’s convention in Milwaukee last Thursday, Donald Trump promised to lower taxes as well as revert to encouraging fossil fuel extraction. The forme US president still believes that the climate-related programs are scams. Apparently Trump believes that the only way to stop inflation tis by increasing the country’s production of fossil fuels, for which the Republican presidential nominee chanted “We drill, baby, dril.” Trump fueled the imagination of his supporters by telling them that the US has more liquid than any other country in the world.

At the Republican Party’s convention in Milwaukee last Thursday, Donald Trump promised to lower taxes as well as revert to encouraging fossil fuel extraction. The forme US president still believes that the climate-related programs are scams. Apparently Trump believes that the only way to stop inflation tis by increasing the country’s production of fossil fuels, for which the Republican presidential nominee chanted “We drill, baby, dril.” Trump fueled the imagination of his supporters by telling them that the US has more liquid than any other country in the world. Trump vows to put an end to the Democrats’ green

Trump vows to put an end to the Democrats’ green  everal legislators in Congress, coming from both political parties, are showing bipartisan support for new tax cut deals despite the country’s current record high national debt. Although the proposed legislation aims to help cash-strapped Americans and businesses, the bill is headed toward tough negotiations in the 2024 sessions.

everal legislators in Congress, coming from both political parties, are showing bipartisan support for new tax cut deals despite the country’s current record high national debt. Although the proposed legislation aims to help cash-strapped Americans and businesses, the bill is headed toward tough negotiations in the 2024 sessions. Republican lawmakers are pushing for the revival of three expired or phased out business tax credits the party introduced via a 2017 GOP-sponsored law. Yet sources say that negotiations for their

Republican lawmakers are pushing for the revival of three expired or phased out business tax credits the party introduced via a 2017 GOP-sponsored law. Yet sources say that negotiations for their  Last week, the upper House or the Senate passed the debt ceiling bill, which Republican lawmakers have vowed to block at the lower house. However, Republicans failed to do so as the bill passed the

Last week, the upper House or the Senate passed the debt ceiling bill, which Republican lawmakers have vowed to block at the lower house. However, Republicans failed to do so as the bill passed the  Upon reaching the Senate, the bill that allows Pres.

Upon reaching the Senate, the bill that allows Pres.

Politics and finance are deeply intertwined, with government policies having a significant impact on financial markets.

Politics and finance are deeply intertwined, with government policies having a significant impact on financial markets.

is an online learning resource where individuals learn important actions to take to start a business and toward achieving financial success. Online programs present different

is an online learning resource where individuals learn important actions to take to start a business and toward achieving financial success. Online programs present different  According to Reuters the country’s post pandemic economy in 2022 and 2023 grew by 7.2% after the government boosted capital investments. Yet the Reuters report also mentioned the fact that India is now the most populous nation in the world after overtaking China with a record of 1.4 billion people. The significance of which is that nearly 53% of that population are below 30 years old, and most of which are without jobs. As a result, tens of millions of jobless young people could end up dragging down India’s economy.

According to Reuters the country’s post pandemic economy in 2022 and 2023 grew by 7.2% after the government boosted capital investments. Yet the Reuters report also mentioned the fact that India is now the most populous nation in the world after overtaking China with a record of 1.4 billion people. The significance of which is that nearly 53% of that population are below 30 years old, and most of which are without jobs. As a result, tens of millions of jobless young people could end up dragging down India’s economy.